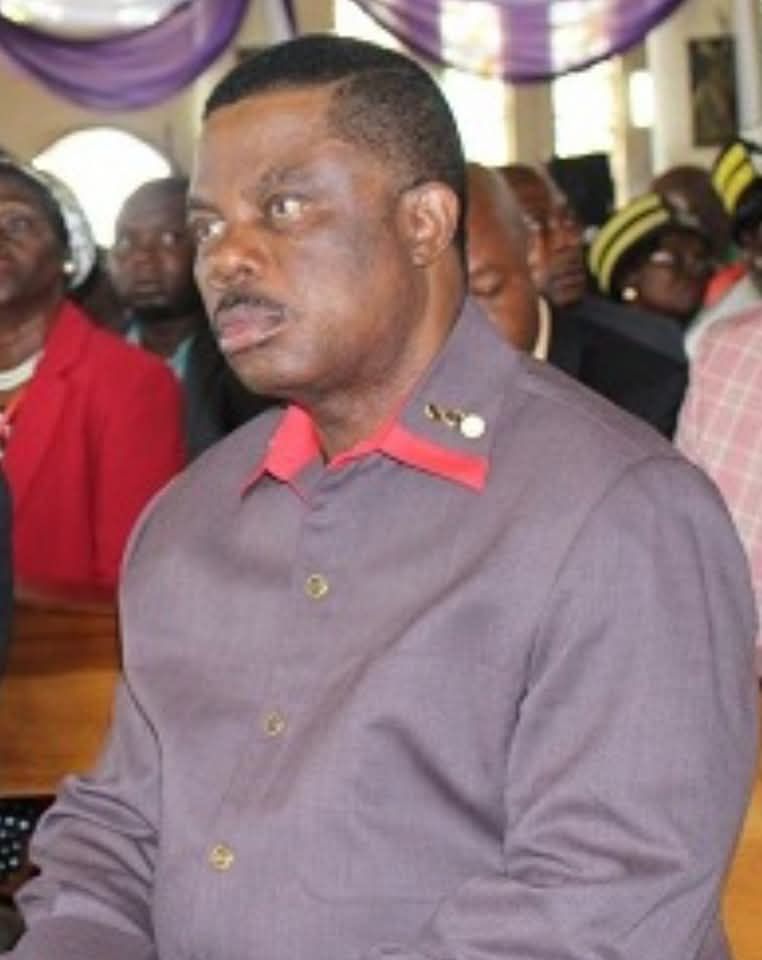

Abuja, NIGERIA — The ongoing trial of former Anambra State Governor, Willie Obiano, resumed on Monday, February 24, 2025, before Justice Inyang Ekwo at the Federal High Court in Abuja. The case, being prosecuted by the Economic and Financial Crimes Commission (EFCC), centers around charges of embezzlement and money laundering, with an alleged sum of N4 billion linked to Obiano’s actions.

During the proceedings, the EFCC presented its 9th prosecution witness, Andrew Ali, a staff member of the Central Bank of Nigeria (CBN) and the head of its licensing office. Ali provided crucial testimony regarding the operations of several companies implicated in the alleged fraud. Specifically, he revealed that three companies connected to the N4 billion transactions were unlicensed to conduct Bureau de Change (BDC) operations.

According to Ali, the three companies in question—Connaught International Service, SY Panda Enterprise, and Zirga Zirga Trading Company—were not authorized by the CBN to carry out BDC business. He also pointed out that Zirga Zirga Trading had been delisted from the CBN’s official list of licensed entities prior to 2014, raising significant concerns about the legality of any transactions involving these firms.

Ali testified that the EFCC had approached the CBN in April 2023, requesting information about the licensing status of 23 companies suspected of being involved in fraudulent activities. In response, Ali explained that the CBN reviewed the companies’ records and discovered that three of them had never been licensed or had been removed from the licensing list. The CBN’s official response, dated May 21, 2023, was presented as evidence in court and marked as exhibits A1-A8.

Under cross-examination by defense counsel, Onyechi Ikpeazu, SAN, Ali reaffirmed that Zirga Zirga Trading Company had failed to meet the CBN’s licensing requirements and had been delisted. He explained that once a company fails to meet the necessary criteria, it is removed from the CBN’s list, and the central bank loses the authority to regulate or supervise its activities. He further emphasized that the CBN makes it clear to the public that any unlicensed companies are ineligible for operation and that this information is published on the CBN’s website.

“The CBN runs public notices to alert the public not to engage with unlicensed companies,” Ali stated. “We only regulate and supervise licensed entities. If a company is not on our list, it is no longer under our jurisdiction.” He also highlighted that all BDCs are required to maintain operational accounts with licensed banks, and that conducting business without such accounts is strictly prohibited.

The revelations raised in the courtroom could have serious implications for Obiano’s defense. If proven that the former governor used unlicensed companies to facilitate the diversion of public funds, the case could see a dramatic escalation in charges related to illegal financial operations.

Justice Ekwo adjourned the proceedings to February 26, 2025, for the continuation of the trial. With further testimony expected, the case continues to draw attention as the EFCC seeks to prove its allegations of embezzlement and money laundering against the former governor.